Home Loan EMI Calculator

Reducing balance method पर आधारित सटीक बैंक कैलकुलेशन

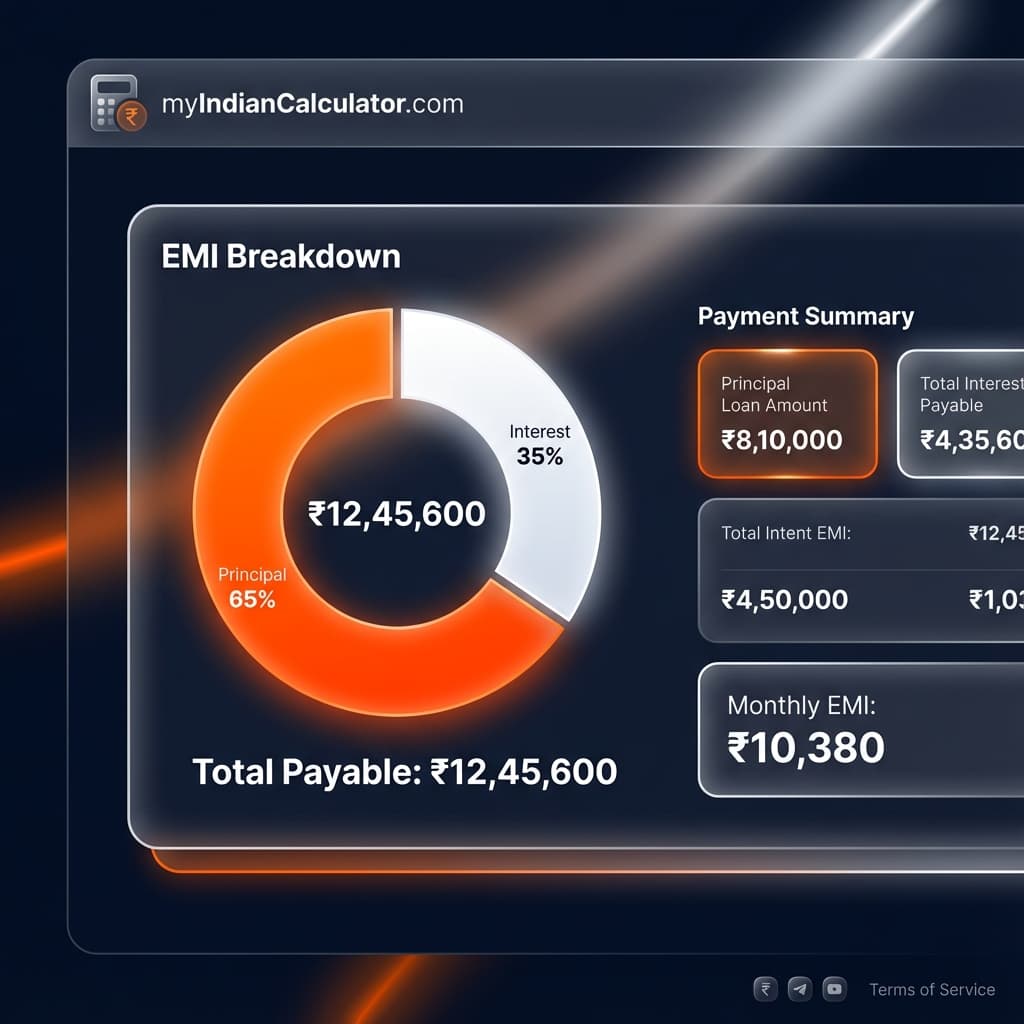

Monthly EMI

₹43,391

Estimated Monthly Repayment

Total Interest (कुल ब्याज)

₹54L

52.0%

Total Payment (कुल भुगतान)

₹104L

Principal + Int.

Annual Balance Timeline

Tax Benefits

Income Tax की धारा 24(b) के तहत, आप सालाना ₹2 लाख तक की ब्याज़ कटौती (interest deduction) क्लेम कर सकते हैं।

Wealth Tip

हर साल सिर्फ 1 एक्स्ट्रा EMI भरने से आपका लोन 4-5 साल जल्दी ख़त्म हो सकता है!

DISCLAIMER: These calculations are for illustrative purposes only and do not constitute professional financial advice. Actual returns or terms may vary based on market conditions or institution policies.

You might also need

Home Loan EMI Calculator - बैंक-ग्रेड सटीक गणना का उपयोग

हमारे बैंक-ग्रेड कैलकुलेटर के साथ अपने होम लोन की EMI का सही अंदाज़ा लगायें। चार्ट और amortization schedule की मदद से अपनी repayment plan करें।

मुख्य विशेषताएं

- •Calculates monthly EMI based on Loan Amount, Interest Rate, and Tenure

- •Supports large loan amounts common in Indian metro cities

- •Provides a detailed yearly and monthly amortization schedule

- •Highlights the total interest paid over the entire loan life

- •Includes an interactive chart for easy visualization of loan balance

- •Fast, simple, and mobile-friendly for on-the-go planning

Home Loan EMI Calculator - बैंक-ग्रेड सटीक गणना की गणना कैसे करें

चरण-दर-चरण मार्गदर्शिका

- 1.Input the 'Principal Amount' (The total loan you want to borrow).

- 2.Enter the 'Annual Interest Rate' offered by your bank in %.

- 3.Select the 'Loan Tenure' in years (typically up to 20 or 30 years).

- 4.The calculator will instantly show your 'Monthly EMI' and 'Total Interest'.

- 5.Scroll down to see the full repayment schedule and yearly breakdown.

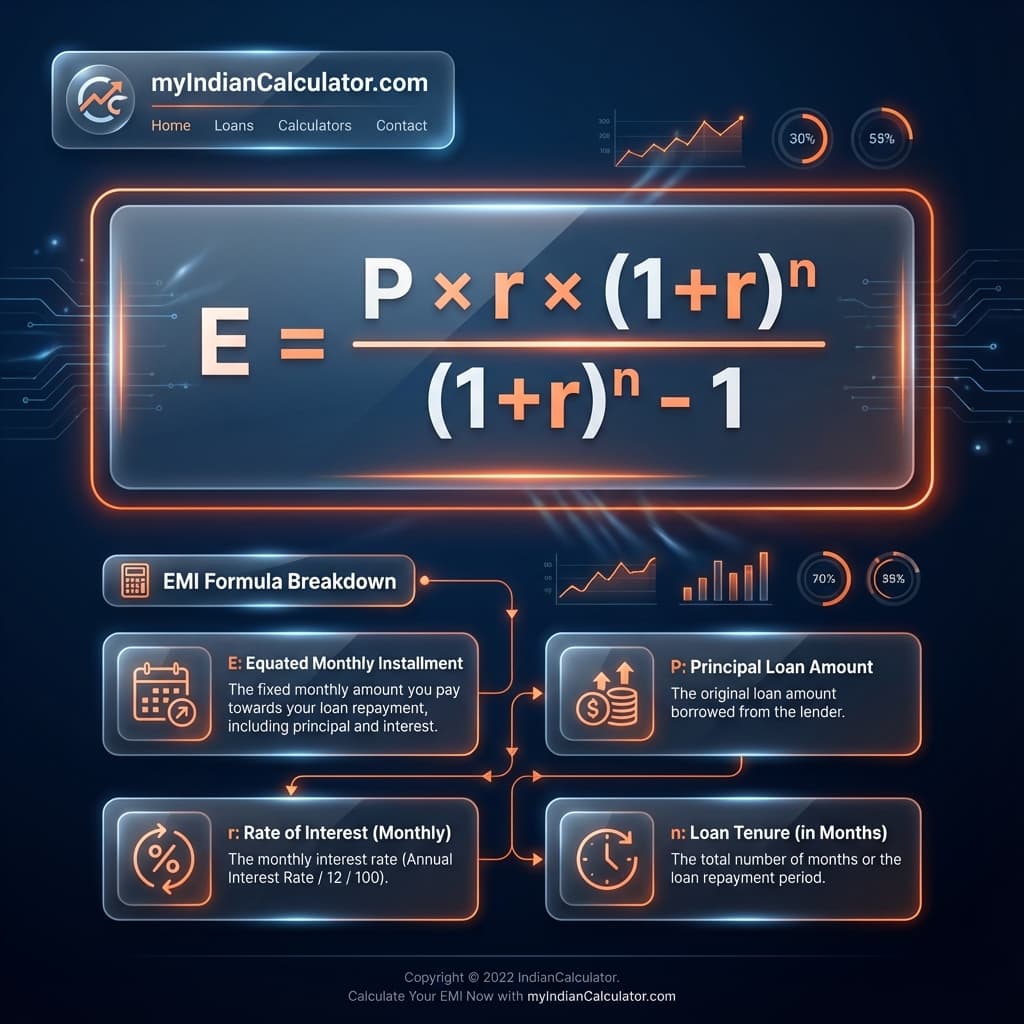

गणना कैसे काम करती है

The EMI is calculated using the standard formula: [P x R x (1+R)^N]/[(1+R)^N-1], where P is the principal, R is the monthly interest rate, and N is the duration in months. Most Indian banks use this reducing balance method.

महत्वपूर्ण धारणाएं

- • Interest is compounded monthly

- • Monthly payments are made at the end of each period

- • Does not account for processing fees or insurance costs

- • Assumes a constant interest rate throughout the tenure

Home Buying Scenarios

Created by MyIndianCalculator Team

Developed by a multidisciplinary team of financial analysts, medical professionals, and data engineers. Our algorithms are rigorously calibrated against official Indian standards (RBI, SEBI, ICMR, WHO) to ensure precision for your financial planning and health monitoring needs.

इस कैलकुलेटर को एम्बेड करें

अपनी वेबसाइट या ब्लॉग पर इस Home Loan EMI Calculator - बैंक-ग्रेड सटीक गणना का उपयोग करना चाहते हैं? नीचे दिए गए स्निपेट को कॉपी करें।

<iframe src="https://myIndianCalculator.com/embed/hi/calculators/%E0%A4%B9%E0%A5%8B%E0%A4%AE-%E0%A4%B2%E0%A5%8B%E0%A4%A8-%E0%A4%88%E0%A4%8F%E0%A4%AE%E0%A4%86%E0%A4%88-%E0%A4%95%E0%A5%88%E0%A4%B2%E0%A4%95%E0%A5%81%E0%A4%B2%E0%A5%87%E0%A4%9F%E0%A4%B0" width="100%" height="600" frameborder="0"></iframe>

MyIndianCalculator पर संबंधित टूल्स

अपने वित्त और स्वास्थ्य को बेहतर ढंग से प्रबंधित करने के लिए अन्य उपयोगी उपकरणों का पता लगाएं:

Home Loan EMI Calculator - बैंक-ग्रेड सटीक गणना

हमारे बैंक-ग्रेड कैलकुलेटर के साथ अपने होम लोन की EMI का सही अंदाज़ा लगायें। चार्ट और amortization schedule की मदद से अपनी repayment plan करें।