Home Loan EMI Calculator

Reducing balance method for accurate bank-grade calculations

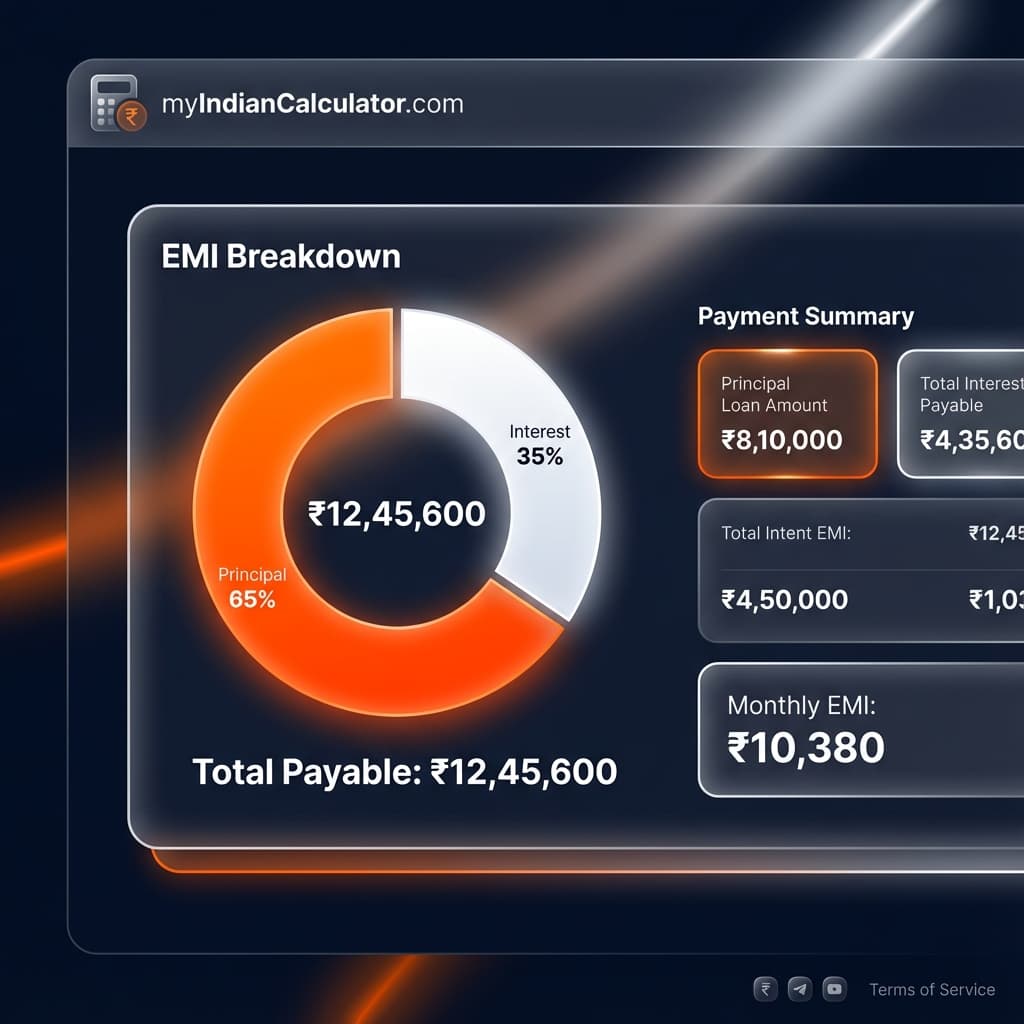

Monthly EMI

₹43,391

Estimated Monthly Repayment

Total Interest

₹54L

52.0%

Total Payment

₹104L

Principal + Int.

Annual Balance Timeline

Tax Benefits

Under Sec 24(b), you can claim up to ₹2 Lakh interest deduction per annum.

Wealth Tip

Paying just 1 extra EMI every year can reduce your tenure by 4-5 years!

DISCLAIMER: These calculations are for illustrative purposes only and do not constitute professional financial advice. Actual returns or terms may vary based on market conditions or institution policies.

You might also need

Using the Home Loan EMI Calculator

Calculate your home loan EMI with our bank-grade reducing balance calculator. Plan your repayment with amortization schedules and charts.

Key Features

- •Calculates monthly EMI based on Loan Amount, Interest Rate, and Tenure

- •Supports large loan amounts common in Indian metro cities

- •Provides a detailed yearly and monthly amortization schedule

- •Highlights the total interest paid over the entire loan life

- •Includes an interactive chart for easy visualization of loan balance

- •Fast, simple, and mobile-friendly for on-the-go planning

How to calculate Home Loan EMI Calculator

Step-by-step Guide & Informational Intent

- 1.Input the 'Principal Amount' (The total loan you want to borrow).

- 2.Enter the 'Annual Interest Rate' offered by your bank in %.

- 3.Select the 'Loan Tenure' in years (typically up to 20 or 30 years).

- 4.The calculator will instantly show your 'Monthly EMI' and 'Total Interest'.

- 5.Scroll down to see the full repayment schedule and yearly breakdown.

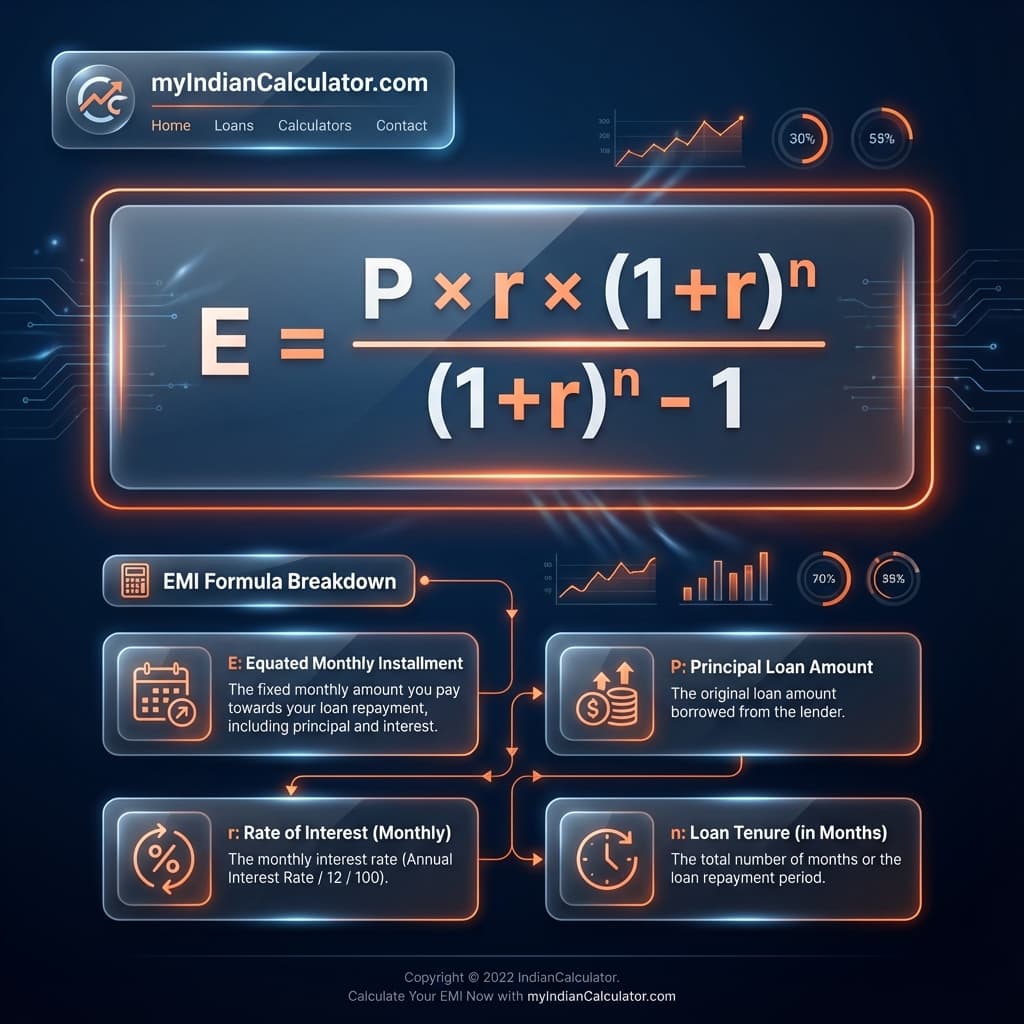

How the Calculation Works

The EMI is calculated using the standard formula: [P x R x (1+R)^N]/[(1+R)^N-1], where P is the principal, R is the monthly interest rate, and N is the duration in months. Most Indian banks use this reducing balance method.

Important Assumptions

- • Interest is compounded monthly

- • Monthly payments are made at the end of each period

- • Does not account for processing fees or insurance costs

- • Assumes a constant interest rate throughout the tenure

Home Buying Scenarios

Created by MyIndianCalculator Team

Developed by a multidisciplinary team of financial analysts, medical professionals, and data engineers. Our algorithms are rigorously calibrated against official Indian standards (RBI, SEBI, ICMR, WHO) to ensure precision for your financial planning and health monitoring needs.

Embed this Calculator

Want to use this Home Loan EMI Calculator on your own website or blog? Copy the snippet below.

<iframe src="https://myIndianCalculator.com/embed/en/calculators/home-loan-emi" width="100%" height="600" frameborder="0"></iframe>

Related Tools on MyIndianCalculator

Explore other helpful tools to plan your finances and health better:

Home Loan EMI Calculator

Calculate your home loan EMI with our bank-grade reducing balance calculator. Plan your repayment with amortization schedules and charts.